This was the message from the UN Secretary General Antonio Guterres on what we need to do to avoid catastrophic climate change. This neatly reflects the South Pole's long-held technology agnostic approach to using finance to scale up climate action and avert climate breakdown. For 17 years, we have been using the Voluntary Carbon Market (VCM) to scale climate action, often financing nascent and risky technologies or projects. We have come a long way after the financial crash of 2008, the collapse of the Kyoto Protocol and the near obliteration of the voluntary carbon markets (VCM). But we have a long way to go to realise the full potential of this market.

As with any maturing market, the VCM is not perfect and needs to become more robust. It is acting in a space that governments are yet to properly or adequately serve. We welcome

fact-based scrutiny, relying on it even, to consistently innovate and improve the integrity of the VCM. However, recent media scrutiny of the market has missed a critical point: the VCM is the only viable solution available to us today, to rapidly scale private finance for nature, local communities, emerging climate technologies, and much more.

It is disappointing and concerning to see incomplete and factually incorrect coverage in Bloomberg regarding South Pole and the Kariba REDD+ forest protection project. In direct contradiction to the message of 'everything everywhere all at once', the article perpetuates misinformation around carbon credits, at a time when

improving and not abandoning these solutions is of paramount importance. In discrediting the VCM, Bloomberg may ultimately harm viable efforts to mitigate climate change and negatively impact the livelihood of thousands of people on the front lines of the climate crisis.

Here, we hope to set the record straight and directly challenge the misinformation.

No over-issuance of credits

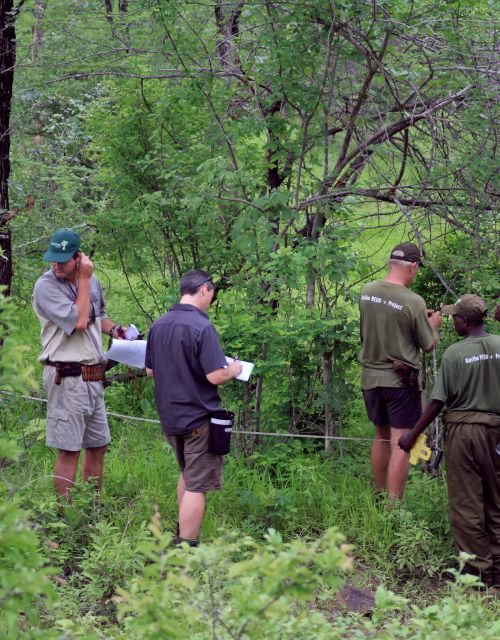

Crucially, the

Kariba REDD+ project has not over-issued, nor will it ever, over-issue carbon credits. This major conservation project in Zimbabwe - funded through the sale of carbon credits - uses a methodology developed by Verra called Verra VM09 to calculate the number of carbon credits issued from the project. This methodology has a built-in, self-correcting mechanism to ensure that issued credits equate to actual and verified deforestation on the ground over the full duration of the project. This is 30 years in the case of Kariba REDD+.

Simply put: When the project is planned, it predicts a deforestation rate (based on 10 year historic deforestation data) and uses this to calculate the issuance of credits. This

predicted deforestation rate - or 'baseline' as it is called - is re-evaluated (or 'validated') after 10 years. Should the real deforestation rate prove to be lower or higher than initially modeled, the methodology demands that fewer or more credits will be issued in the following 10 year crediting period. This ensures that over the full lifecycle of a project, the volume of issued credits corresponds to actual emissions reduced.

Every two years from the beginning of the project, independent third party auditors verify, among other things, the amount of CO2 present in the soil and forest, which is another factor considered when calculating the volume of credits issued.

Both the validation and correction-mechanism are built into the methodology, not as an after-thought, but in clear anticipation of, for example, political changes that are likely to impact a developing country's deforestation rate. In the case of Zimbabwe, the deforestation rate decreased because of a significant change in policies - notably after the death of President Mugabe in 2019, who had supported an agriculture policy that did not protect forests.

None of this was explained to Bloomberg's readers. In fact, the piece suggests that credits sold by South Pole to its clients do not represent real CO2 emission reductions. This is false. South Pole clearly communicated to Bloomberg that it has not sold the entirety of credits issued by Verra (36 million verified carbon credits) but only 23 million. Even with a conservative outcome of the revalidated project baseline the expected trees saved are in line with what South Pole has in fact sold.

The authors simply did not present

South Pole's explanation of why the project has never and will never overcredit over its lifetime. Surprisingly, the story does not include Verra's own response to these allegations, which is central to this issue. And perhaps most importantly, the article does not explain the reasons why deforestation in Zimbabwe - or any politically volatile country - is almost impossible to accurately predict.

Revenue distribution

The article severely mischaracterizes the revenue distribution of the project by claiming that '

Most of Kariba's €100 million in proceeds have gone to South Pole and its project partner, a company called Carbon Green Investments, not — as both companies previously indicated in interviews and public blog posts — to people in the rural communities who do the work of fighting deforestation.'

This is misleading. What Bloomberg fails to explain is that CGI is the heart and soul of the project - it is the entity that made sure the project survived while no one was buying carbon credits. CGI and the local communities have together received $57 million of the project revenue from the sale of carbon credits -

clearly a majority of the funds. CGI is part of the 'local communities' and fully represents their interests.

The benefit to South Pole

Lastly, the article does not adequately explain how South Pole was paid. Initially, we were hired to do the marketing and sales of the project's carbon credits, for which we receive 25%, which is normal in this industry (described in detail

here). This fee also includes other company overheads and the cost of regular MRV (monitoring, reporting and verification) by 3rd party auditors.

When the price of carbon credits tanked due to the failure of the Kyoto Protocol, South Pole decided to support the project financially to avoid its bankruptcy. We purchased high-risk assets with hardly any value and with no buyers at the time, solely to ensure that the project saw a revenue stream and could continue to support local communities. The project could not get a loan elsewhere, especially not in Zimbabwe, which faced hyperinflation and political instability. South Pole took a massive risk - also considering the small size of our 150 person company back then - and kept these essentially worthless credits on its books. We benefited only when carbon credit prices went up, for some as long as six years after we purchased the credits. This is a risky investment that few other financial institutions would have made. None of this was shared with the readers.

Speeding up, not slowing, climate action

It is well known that we need massive amounts of financing to protect forests as quickly as possible. While the voluntary carbon market is not perfect, it is the only viable solution available today to rapidly scale up private financing for nature, but also for local communities, emerging climate technologies, and much more.

By omitting or mischaracterizing relevant information, Bloomberg is not only casting doubt on the intentions of the Kariba REDD+ project and South Pole but also undermining the only carbon market that is working today, and possibly slowing down climate action by the private sector, which is something the world cannot afford right now.

Renat Heuberger

CEO, South Pole