Blog Categories

Purchase carbon credits and finance climate action

Choose from one of the world’s largest portfolio of high-integrity climate action projects to drive credible climate action and sustainable development around the world.

South Pole’s Digital Solutions

We understand that your business is under more pressure than ever to step up its sustainability agenda. That is why we have the software integrations available for you to get started today.

Our commitment to integrity

Our ambition is to lead the way in carbon project risk management, quality, and compliance protocols.

Nestlé

With a significant agricultural value chain, including multiple brands with individual greenhouse gas footprints, achieving Net Zero for Nestle is a complicated process. Nestle needed a roadmap to get there.

Carbon Credits

Buy carbon credits from the world's largest portfolio of carbon projects to protect the planet and transform lives.

Manage & Calculate your emissions now

Our platform enables individuals and organisations alike to measure, track and compensate for their emissions.

The South Pole 2024 Net Zero Report

Destination Zero: the state of corporate climate action

Penguin Perspectives Blog

Gain fresh perspectives and opinions from our in-house experts and guest authors.

South Pole's 2024 Net Zero Report

Survey finds that most companies across nearly all sectors are going quiet on green goals.

Catching up with Climate

Stay up-to-date on the biggest climate news, policies, and innovations

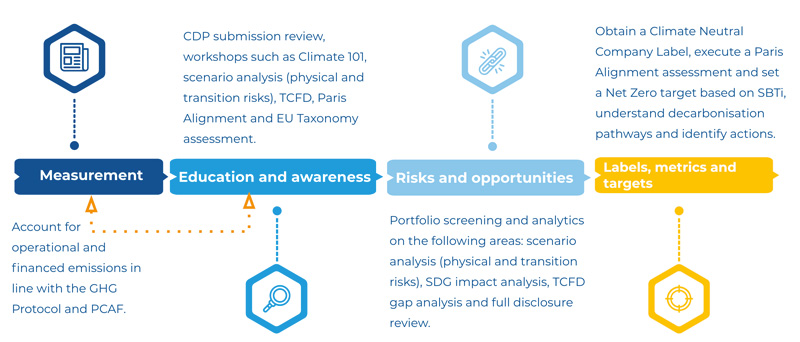

South Pole believes that a Net Zero target is a part of every organisation's Climate Journey.

Read more