Governments are joining in too – a prelude to what may be a step towards mandatory global rules around climate-related disclosure.

Why is the TCFD having such an impact and how can companies get ahead of likely regulation?

Inside many financial institutions, sustainable finance is shifting from an activity largely led by corporate social responsibility and philanthropy to an area more closely integrated with overall corporate strategy and business activities.

In the words of our CEO Renat Heuberger, “in addition to reducing risk by, for example, moving away from companies who are likely to do poorly in a warmer world, many have spotted an investment opportunity in actively looking for businesses that will benefit from – or directly help – the transition to a net-zero economy."

Governments have also recognized that without reliable climate-related financial data, capital could be misallocated, translating into a bumpy transition to a low-carbon economy.

Cue in the Task Force on Climate-related Financial Disclosures (TCFD), which in 2017 introduced a framework to improve public disclosure of climate-related financial information, and help companies better structure their internal approach to assessing climate risks and opportunities.

Governments are driving mandatory climate disclosure

Governments around the world recognise that the TCFD framework provides the right setup to address climate change-related issues at both a strategic and an operational level. While TCFD-compliant reporting is still voluntary, the market is moving fast, hinting at a shift to mandatory TCFD reporting.

In December 2020 the Swiss government took bold action by laying the groundwork for making the implementation of the TCFD recommendations mandatory. The Federal Council has advised companies to apply the recommendations on a voluntary basis for now, while it continues to work on a bill that will make the recommendations binding for all sectors of the economy within the coming year. The proposal comes hot on the heels of a decision made by the UK government, which became the first country globally to announce mandatory TCFD-aligned disclosures by 2025, with a significant portion of the requirements due to be in place as soon as 2023.

The UK and Swiss governments might have set a precedence but it is only a matter of time before other governments follow suit. New Zealand has already announced plans to make climate-related financial disclosures mandatory for some organisations, which could well come into effect as soon as 2023. The Canadian government has tied COVID-19 relief to TCFD-aligned climate disclosure. In addition, over 100 regulators and governmental entities across the globe have voiced support for the TCFD.

With all of this happening on a government level, it is high time that companies shift gears to keep up with political developments – and get ahead of anticipated regulation.

Why companies need to urgently align with TCFD recommendations

There are several key reasons why implementing the TCFD recommendations today is a good idea – not least due to the fact that TCFD is already accepted as the standard framework. In 2018, for example, CDP questionnaires were overhauled to reflect the TCFD recommendations.

Also, momentum is growing: over 1,500 organisations are already supporting the TCFD. They realise the significant benefits of its standardised approach to effectively and consistently disclose climate-related risks and opportunities. Since the introduction of the recommendations in 2017, both the number of companies disclosing TCFD-aligned information and the reporting quality has improved as companies progress on their TCFD journey. The process itself has also improved: according to the TCFD's most recent review, the processes for identifying and assessing climate-related risks among TCFD-aligned companies had shown the greatest improvement since 2017.

What are some concrete advantages of TCFD reporting? Companies that align their disclosure with the TCFD reporting framework can:

- Maintain credibility and safeguard reputation among investors and the public. Widely accepted frameworks, like the TCFD, make it very clear to investors that businesses are considering climate-related impacts on a strategic level.

- Implement a structured process for integrating climate risks into strategic decision making. The TCFD framework allows for a more efficient way of structuring mitigation and adaptation measures, which can provide a competitive advantage over companies moving forward with less focus.

- Develop expertise and upskill staff. Starting the TCFD process now will ensure companies have enough time to build the resources and the know-how needed to meet the requirements when they become obligatory in the future.

For those who are not yet convinced, we have also summarised five reasons for why TCFD-reporting is so successful and relevant for both companies and investors.

1. Focused:

In comparison to other sustainability frameworks the TCFD has climate change as its single core theme, without trying to cover the whole ESG space.

2. Material:

The TCFD framework aims to make the risks and opportunities posed by climate change equivalent to other enterprise-wide risks and opportunities that companies face. It therefore creates the long needed bridge between sustainability and financial/risk modelling.

3. Holistic:

The TFCD framework addresses climate issues across all levels of a company. The four pillars of the TCFD - strategy, governance, risk management and metrics & targets - allow it to be applied from the board level down to specific action taken at facility level.

4. Targeted:

The TCFD framework divides climate-related issues along two dimensions, separating between physical and transition related topics and between risks and opportunities. Doing so enables a 360° view on climate impacts and resilience.

5. Forward-looking:

We can learn a lot from the past, but if we want to tackle the climate crisis we need to change our thinking and look ahead - focusing more on where we want to go and less where we came from. The TCFD-framework took a huge step by making forward looking scenario analysis a key component of its assessment.

Getting ahead of regulation – where to start?

The biggest roadblock for corporate adoption of TCFD reporting remains availability and suitability of data, but also the effective gathering of data, which can be often hindered by internal structures and lack of clear ownership. In most companies, effective TCFD reporting requires seamless collaboration across multiple teams, from sustainability units to risk experts, who may not all be 'TCFD-trained'.

It also does not help that there are still some limitations in the reporting framework: for example, just 7% of companies in TCFD's latest review were disclosing information around the resilience of their strategies. Disclosures were also over four times more likely to be found in sustainability reports, rather than financial filings or annual reports.

Due to the cumbersome data collection process, the gaps in the TCFD framework, and the complexity of the data itself, many companies are kicking the can down the road rather than setting up the necessary reporting structures.

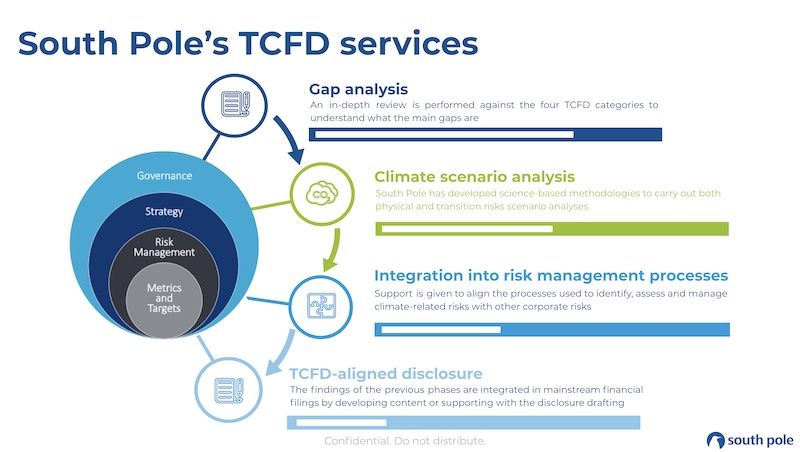

However, the benefits of aligning with the TCFD now outweigh the reporting challenges. By following a structured approach and by building internal capabilities together with external experts, companies can better identify physical and transition risks and opportunities. A good place to start is by carrying out a gap analysis to better understand the status-quo and get familiar with the topic. The next big step is then to conduct a climate-scenario analysis. The information from these two activities creates the building blocks for a robust reporting process, one that can be integrated into existing risk management processes.