Contactez-nous

- A propos

- Solutions

- Notre impact

- Evénements et Actualités

- Carrières

- Réduire vos émissions (en anglais)

A propos

Voir tout

- A propos A propos

- Notre mission

- Equipe dirigeante

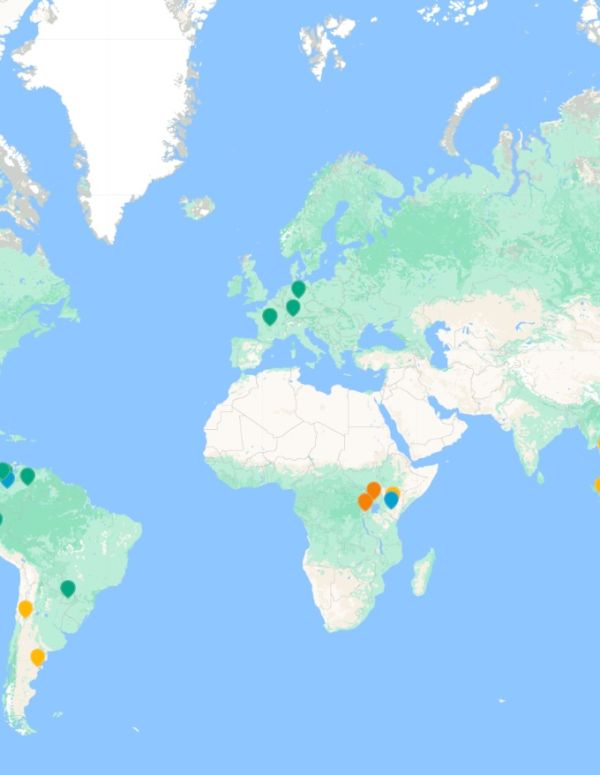

- Nos bureaux

- Notre engagement en matière d'intégrité

Notre engagement en matière d'intégrité

Débutez votre transition climatique

En savoir plus

- A propos Solutions

- Conseil Climat

- Certificats environnementaux

- Financer la décarbonation à grande échelle

Notre engagement en matière d'intégrité

Débutez votre transition climatique

En savoir plus

- A propos Notre impact

- Nos clients

- Découvrez nos projets

Notre engagement en matière d'intégrité

Débutez votre transition climatique

En savoir plus

Notre engagement en matière d'intégrité

Débutez votre transition climatique

En savoir plus

Solutions

Voir tout

- Solutions Conseil Climat

- Maîtrisez la réglementation environnementale : mesurez votre impact climatique, rapportez et évaluez

- Fixez des objectifs fondés sur la science et préparez durablement votre transition vers le net zéro

- Décarbonisation de la chaîne d'approvisionnement : Engager les parties prenantes et réduire les émis

Investissez dans l’action climatique

South Pole believes that a Net Zero target is a part of every organisation's Climate Journey.

Find out more

- Solutions Certificats environnementaux

- Comprenez les marchés en constante évolution, planifiez un portefeuille prêt pour l'avenir.

- Choisissez des crédits carbone et des certificats environnementaux prêts à l'achat

- Sécurisez un flux à long terme de crédits carbone

Investissez dans l’action climatique

South Pole believes that a Net Zero target is a part of every organisation's Climate Journey.

Find out more

- Solutions Financer la décarbonation à grande échelle

- Finance decarbonisation at scale

- Découvrez nos projets

Investissez dans l’action climatique

South Pole believes that a Net Zero target is a part of every organisation's Climate Journey.

Find out more

Investissez dans l’action climatique

South Pole believes that a Net Zero target is a part of every organisation's Climate Journey.

Find out more

Notre impact

Voir tout

- Notre impact Nos clients

- Voir tout

Nestlé

Débutez votre transition climatique

En savoir plus

- Notre impact Secteurs

- Voir tout

Nestlé

Débutez votre transition climatique

En savoir plus

Nestlé

Débutez votre transition climatique

En savoir plus

Evénements et Actualités

Voir tout

- Evénements et Actualités Presse

- Nos dernières actualités

- Communiqués de presse

Rapport Net Zéro 2024 - South Pole

Votre rendez-vous avec l’actualité climatique

Débutez votre transition climatique

En savoir plus

- Evénements et Actualités Événements

- Evénements à venir

- Evénements passés

Rapport Net Zéro 2024 - South Pole

Votre rendez-vous avec l’actualité climatique

Débutez votre transition climatique

En savoir plus

- Evénements et Actualités Blog South Pole

- Pratiques d’agriculture régénératrice en France: retour d'expérience d'agriculteurs

- Intégrité, innovation et impact : les principes d’une action climatique crédible

- Reporting CSRD : bien se préparer à l'évaluation de la double matérialité

- The evolving definition of integrity in the carbon market

- Voir tout

Rapport Net Zéro 2024 - South Pole

Votre rendez-vous avec l’actualité climatique

Débutez votre transition climatique

En savoir plus

- Evénements et Actualités Publications

- Tous les téléchargements

- Le petit guide de la CSRD (Corporate Sustainability Reporting Directive)

- Voir tout

Rapport Net Zéro 2024 - South Pole

Votre rendez-vous avec l’actualité climatique

Débutez votre transition climatique

En savoir plus

Rapport Net Zéro 2024 - South Pole

Votre rendez-vous avec l’actualité climatique

Débutez votre transition climatique

En savoir plus

A propos

Solutions

- Maîtrisez la réglementation environnementale : mesurez votre impact climatique, rapportez et évaluez

- Fixez des objectifs fondés sur la science et préparez durablement votre transition vers le net zéro

- Décarbonisation de la chaîne d'approvisionnement : Engager les parties prenantes et réduire les émis

Notre impact

Evénements et Actualités

- Pratiques d’agriculture régénératrice en France: retour d'expérience d'agriculteurs

- Intégrité, innovation et impact : les principes d’une action climatique crédible

- Reporting CSRD : bien se préparer à l'évaluation de la double matérialité

- The evolving definition of integrity in the carbon market

- Voir tout

Notre engagement en matière d'intégrité

Investissez dans l’action climatique

Nestlé

Rapport Net Zéro 2024 - South Pole

Votre rendez-vous avec l’actualité climatique

South Pole believes that a Net Zero target is a part of every organisation's Climate Journey.

Find out more